“Policy makers have begun talking about letting the inflation rate rise above its 2% target.”

From Bloomberg.

According to a recent article by Bloomberg, the Federal Reserve is looking to

handle inflation a little differently this time around. Previously, the Fed relied on the Phillip’s Curve forecasting model. The resulting policy saw inflation rates stay below the 2% mark during the previous period of economic recovery.

“Policy lags — the time between the Fed’s actions and the resulting economic outcomes — mean inflation will subsequently rise above 2%.” Bloomberg.

So what does this mean for those who invest in farmland?

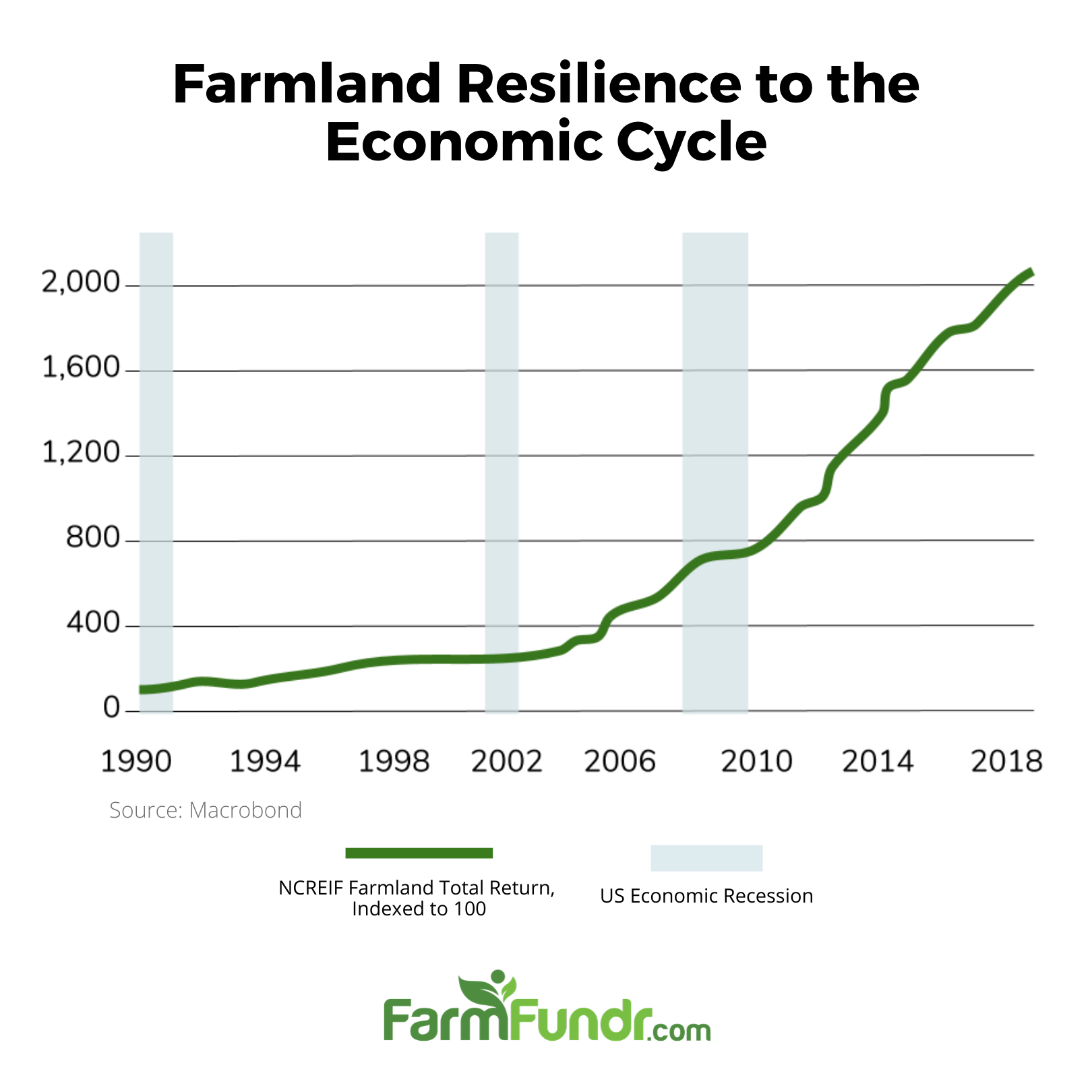

Let’s take a look at the historical relationship between inflation and farmland returns. Traditionally, food and commodity prices will rise with an increase in inflation. Inflation rates in the 1970’s averaged 7.6%, while the Farmland index saw an annualized return of 18.9%.

When investors think of a hedge against inflation, gold is often the first thing that comes to mind. This made sense when farmland wasn’t an easily accessible investment class. Investors in gold are happy knowing their holdings will keep pace or may even outpace inflation. However, cash flow never entered the equation. Farmland is an asset that combines the best of both worlds.

With new options for taking fractional ownership in farmland (such as a crowdfunding platform like FarmCek) , it's worth taking a closer look at which asset provides the best hedge.

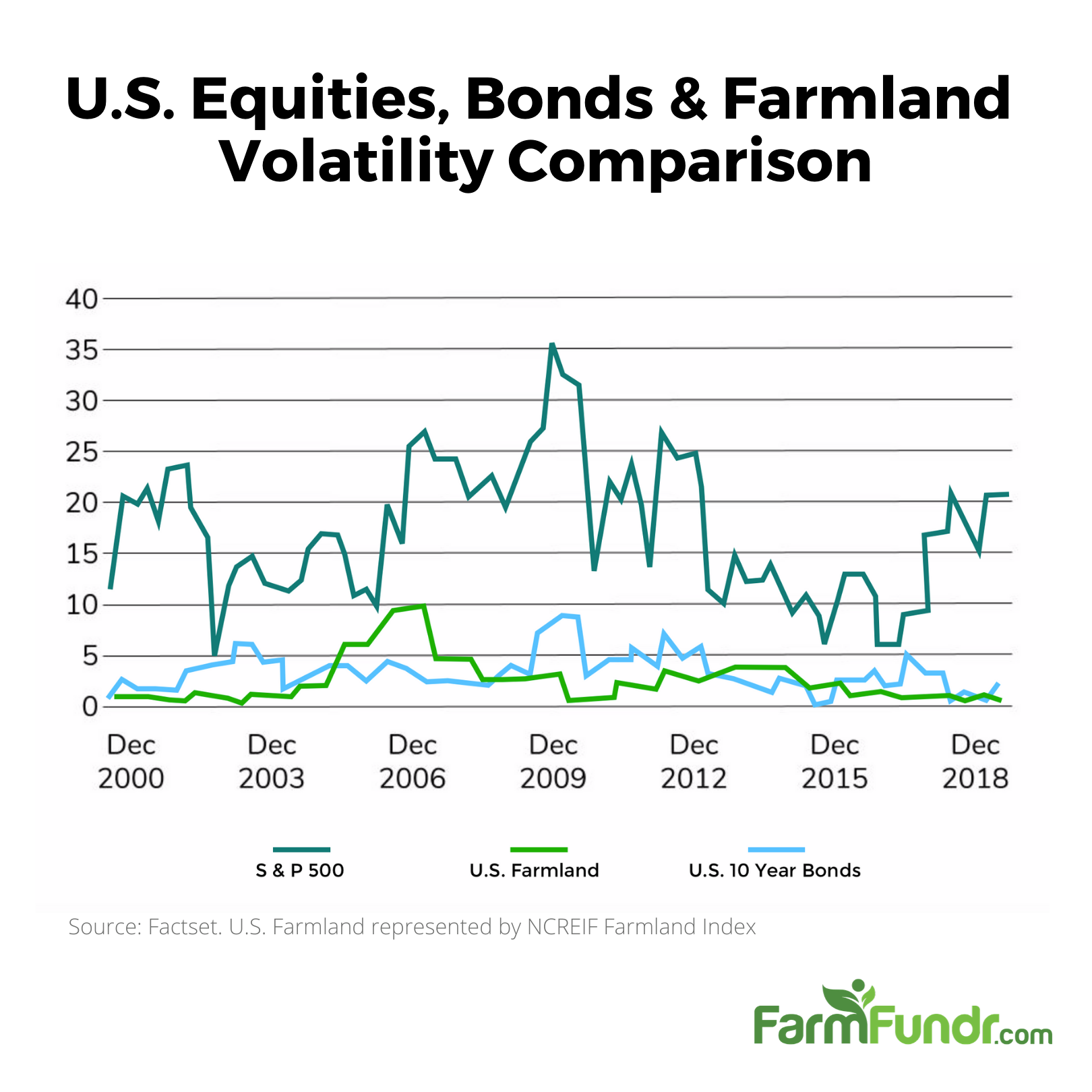

Farmland combines passive cash flow, appreciation that outpaces inflation and, amazingly, less volatility than gold.

Investors don’t tend to view stocks as hedge against inflation. It's likely that when investing in the stock market, you’re looking for safe index funds for retirement, or for outsized gains.

With the stock market nearing a return to all time highs, despite economic and social turmoil, finding those outsized gains can be difficult.

Farmland may not provide stock market-like returns in the short term, but it can provide consistent returns (eveen 13% or more), without the high volatility and high risk that is associated with stocks.

Farmland also stacks up favorably against index funds. Consistent returns over a longer period oof time and the likelihood of returns fluctuating to higher than normal make this type of investment favorable. As an example, in 2019 FarmCek's Almond Orchard Investment Property produced 8.8% more almonds than expected and sold at 6% higher than our sale price estimates. While these type of positive fluctuations are never guaranteed, it certainly is possible.

In the past, investors interested in agriculture were left with options of ETFs or direct ownership. ETFs have seen less than stellar returns while direct ownership requires time, significant funding, and an expertise that most investors just do not have.

If protecting your wealth and hedging your investments during times of economic certainty are important to you, it is definitely worth it to explore an investment in farmland.

At FarmCek, we offer two unique options to invest in farmland. First is our farmland crowdfunding portal. Accredited investors (and in some cases in the future, non-accredited) can purchase a share in a high profit potential, carefully vetted and managed, farmland operation. They can do this for as little as $10,000. If this option is of interest to you, you can create a complimentary account where you'll gain access to explore the available farmland crowdfunding opportunities. This option allows investors to experience the benefits of direct ownership without the expertise or funding amounts required to buy and run an entire farm.

If full ownership of a quality farmland operation is more appealing to you, our team of expert farmers and farmland investors can tailor an investment that satisfies your goals with our FarmFindr program. This option is most suitable for investors with a large amount of capital to invest in farmland.

Ultimately, farmland has proven to have a positive correlation with inflation. More-so than bonds, the stock market and gold. As time has proven, no investment offers a hedge against inflation like farmland.