With an exceptionally volatile market over the past few weeks, due to the Covid-19 Pandemic, savvy investors are moving their funds to farmland. As time progresses, it is becoming increasingly clear that farmland has considerable inherent value that is likely to increase across posterity. Even during times of economic uncertainty, such as now, agriculture is outperforming other asset classes. Investors are moving their funds from stocks, bonds, mutual funds and precious metals to farmland. Why? Because food is an item that people will continue to buy, no matter the conditions of the economy, because it is vital for life.

The Current Economic Environment

The modern economy is currently characterized by the ongoing threat of coronavirus, also referred to as Covid-19. Even if governments around the world get coronavirus under control, it is likely to reappear once again when the cool air returns next winter. The moral of the story is, we just can’t be certain exactly when and how long a global situation can impact the economy and investors should look for options for long-term financial preservation.

There is no sense investing hard-earned money in highly volatile stocks, mutual funds and urban real estate when a historically resilient and consistent option like farmland is available. Regardless of economy, we all have to eat, and there is a finite amount of farmland available. The masses desperately need the food produced on America's farmland. This essential need for nutrition will exist as long as the human race survives. Therefore, farmland in the United States and beyond is likely to increase in value or at least retain its value in the years, decades and centuries ahead. The same cannot be said of comparably volatile investments such as stocks, mutual funds, options trades and urban real estate.

Farmland as an Asset Class & Performance Over Time

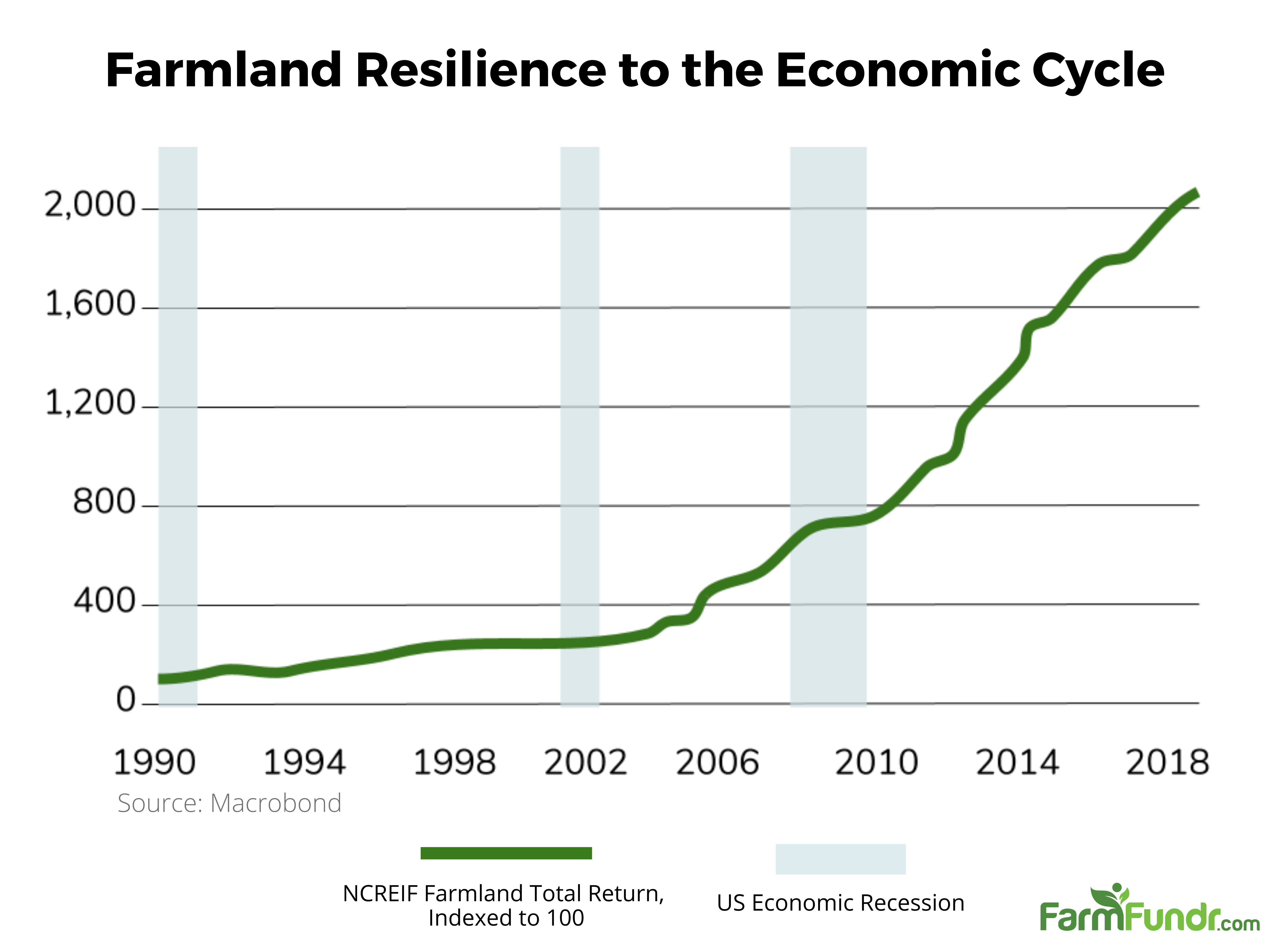

The overarching economic uncertainly detailed above is likely to prevail in the years and decades ahead as the population continues to skyrocket and land becomes more scarce. As a result, farmland as an investment will continue to spike upward. The bottom line is the world needs to feed that many more people as the population continues to increase, nearly guaranteeing farmland as an asset class will ascend in value. According to Global AgInvesting, the NCREIF Farmland Index indicates farmland in the United States provided a 15.8% return during the Great Recession of 2008. The country’s farmland followed up this impressive performance with a 6.3% return the next year. The sector turned in a double-digit investment performance several years after the economic slide, proving this once-neglected component of the economy is quite valuable when other industries struggle.

It is particularly interesting to note the Farm Credit system stood strong and remained active during the recession, providing loans even when the world’s leading banking institutions went belly-up or nearly folded. Though few

know it, large farmland portfolios were leveraged in this difficult period of time at solid long-term rates. As time progresses, it is becoming increasingly clear the farmland sector is somewhat counter-cyclical to the economy

as a whole, making it one of the best investments during recessions. However, this is not to say farmland will decrease in value when the economy performs well. The bottom line is people will always need food grown

on farms, especially as the global population continues to climb higher and higher with each passing year.

Reasons why Farmland is Low Volatility

Take a look at the stock market amidst the coronavirus or any other period of uncertainty and you will find it is incredibly volatile. Even real estate values in or near the country’s midsize and large cities have proven quite volatile in our increasingly uncertain world. Due to a deeply interconnected global economy, a single event in China, Mexico, the United States or elsewhere has the potential to spur dramatic fluctuations in the values of:

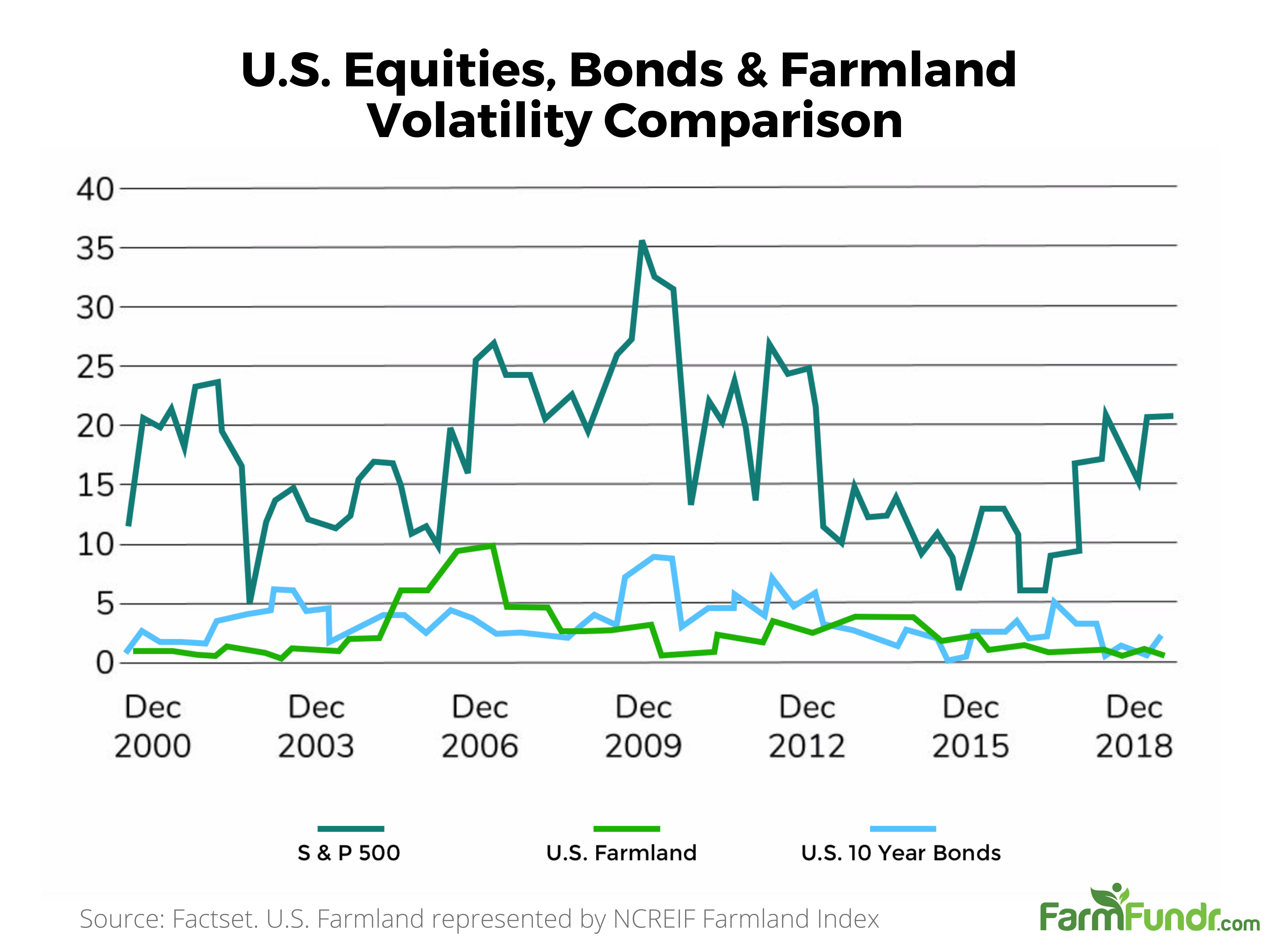

There is one investment that remains the same, a true constant amidst the seemingly inevitable market volatility: farmland. Consider the volatility of the S&P 500, 10-year bonds and United States farmland between the dawn of the new millennium and 2018. Domestic farmland returns shared the same level of volatility with the 10-year bonds yet were less volatile than equities in this period of time. Furthermore, farmland returns have surpassed those of 10-year bonds in recent decades. This inherently low volatility is quite important in the current era characterized by an uncertain economy and society as a whole. In fact, the agricultural sector proved relatively profitable even amidst the 2008 Great Recession.

Regardless of how the global and local economy fare, people will always need to eat. The food consumed in cities, suburbs and rural areas is grown on our country’s farms as well as farmland in other nations. This means a farmland investment is one of the safest places to “park” your money as unpredictable buying and selling occurs on increasingly volatile stock market exchanges and real estate markets.

Another important consideration, is that the physical land designated for farming is inherently limited. Though it is possible to expand farming operations in parts of the Midwest and northeast, it is impossible to farm in arid areas such as the majority of the southwest. This means farmland in the United States and beyond is inherently limited. However, it appears as though human population has no such limits. As a result, there is an emerging imbalance between the limited land available for farming and our ever-growing population. Though we can certainly make more automobiles, apartment complexes and big city skyscrapers, we cannot make more farmland. This element of inherent scarcity makes farmland worth that much more as our planet’s natural resources dwindle and the population reaches new highs with each passing year.

Therefore, farmland is likely to increase in value across posterity, or, in the worst case scenario, maintain its value. The same cannot be said of other investments that do not have such supply constraints. Though there is undoubtedly considerable demand for electronics, automobiles and commercial real estate, these items and markets can be produced in seemingly endless numbers. Therefore, they lack the inherent value of comparably limited farmland that will always be coveted yet cannot be produced in an infinite manner.

Why People Turn to Farmland During Times of Uncertainty.

The resilience and consistency of farmland returns is exceptional compared to other investment alternatives. Farmland has a number of distinct characteristics, including: low volatility, attractive yields, negative correlation to equities and a resounding resilience during unfavorable economic climates. These factors certainly create a compelling case to include farmland in a diversified portfolio.

Farmland is much more predictable both in terms of value as well as output as opposed to stocks, mutual funds and traditional real estate. A farmland investment is very likely to provide a solid return as time progresses. More importantly, this return is likely to prove steady even if the global economy continues to falter or completely collapses. People will always need nutritious, tasty food, making farmland quite the savvy investment in 2020, 2030 and beyond.

Farmland and Inflation

The United States federal government and other governments across the world typically print money in response to economic crises such as the coronavirus pandemic. As a result, money usually loses some of its value due to inflation. Inflation makes the money you worked hard for worth that much less. In other words, time will work against you unless you invest with prudence. The smartest investors understand the inherent risk of inflation in response to inevitable crises that trigger money printing. This is precisely why it is sensible to invest in assets that provide a hedge against inflation. Farmland is one of those precious few inflationary hedges. Farmland generates assets such as food and other raw materials that people will always need, regardless of the nuances of the economy or the latest political/social crisis. Farmland benefits from the dollar’s inflation as farm acres are worth more due to the corresponding upward bump in price in real dollars.

Add in the fact that supermarkets across the globe hike food prices when crises such as the coronavirus occur and it is that much easier to understand why crop income spikes during tumultuous economic times. In the end, farmland proves to be quite the savvy hedge against inflation, similar to gold, yet still producing a yield that every human being values, regardless of his or her specific position on the globe or nuanced demographic characteristics.

Farmland's Performance During Uncertain Times Compared to Other Popular Investment Vehicles

Though few know it, farmland has generated positive returns across the board for decades, going all the way back to the early 90s. There is a common misconception that precious metals such as gold and silver are the only “safe havens” when there is economic or political turmoil. The average investor has understandably overlooked the safe haven of farmland simply because, up until now, investing in farmland was very complex and expensive. With equity crowdfunding platforms such as FarmCek, investors can take partial ownership in quality USA farmland, essentially owning and profiting from the harvest of that land. While those who invest in commercial real estate, precious metals such as gold, the S&P and individual stocks are limited to making money in a single revenue channel, farmland investors have the opportunity to make money in two ways:

FarmCek’s model is different from other farmland platforms, as it allows you to own the actual farmland, the crops on them and the profits from the harvest. Profiting from the harvest directly is a huge benefit because

you do not have to rely on farmers honoring their rent obligation in the more common farmland equity model. During economic times of uncertainty, relying on rent is a less stable way to receive profits from your farmland. With

an investment in a FarmCek property, an expert farm manager does the work, while you reap the financial reward of the annual harvest sales and the appreciation of the land.

If you are still in doubt as to the value of farmland, consider the fact that there is a seemingly endless number of stocks and mutual funds to invest in. Commercial real estate ventures pop up left and right. However, with farming, the farmland owner does not have to compromise on income from rent. Income stems directly from the farm's harvest sales as well as land value appreciation over time. Keep in mind, traditional landlords who own residential or commercial properties are subjected to rent forgiveness programs during difficult economic times that make it challenging to collect anticipated revenue.

Precious metals such as gold are discovered in new locations with regularity. In contrast, there is only so much land that can be farmed to produce the fruits, vegetables and other food we need to survive and thrive as a species. In fact, the nation’s amount of farmland is actually shrinking, making this investment that much more valuable with each passing day. Though the world’s population growth shows no signs of slowing down, farmland in the United States is shrinking by an astonishing three acres per minute. As the demand for food from an ever-growing population continues to increase, our shrinking farmland will become that much more valuable.

Now that we have established farmland will hold steady when the economy sours, it is time to shed light on the inherent instability of other investments during such perilous times. The vast majority of stocks, mutual funds, bonds and even cryptocurrencies decline when market selloffs occur. Precious metals sometimes maintain their value or spike in value yet they are the sole aberration to the widespread selloff. Farmland is the other exception, bucking the trend during economic downturns as it is not correlated to other major asset classes. Diversify your investment portfolio with a farmland purchase and you will sleep well at night knowing this land holds its value or even appreciates in value while the rest of your assets decline.

Farmland Investment for Asset Diversification

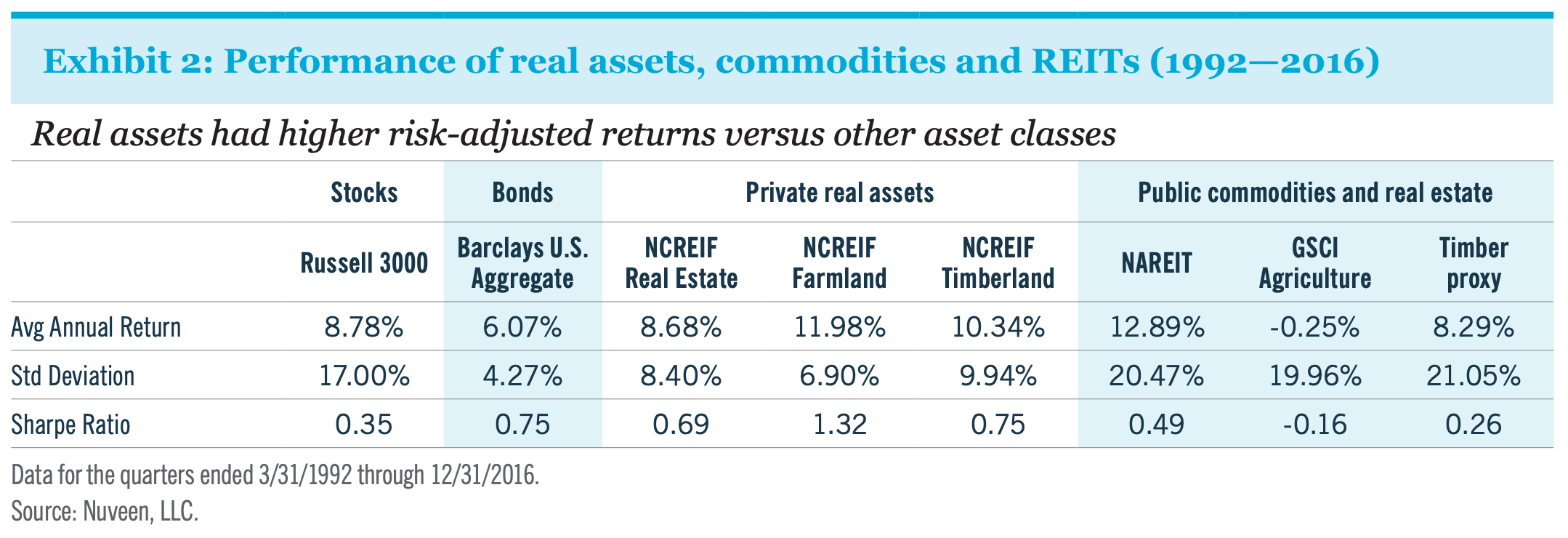

According to this white paper published by TIAA Nuveen, real assets such as farmland prove to be highly effective investments in terms of asset diversification.

TIAA’s research shows the addition of farmland hikes the average yearly investment return while reducing the portfolio’s volatility. In plain English, this means farmland is a necessary hedge against investments in the stock

market and other common investments. Take a look at the charts of these investments, compare them to the value of farmland returns over the same periods of time and you will find they often move in opposite directions. The

Sharpe Ratio reinforces this trend. The higher an investment’s Sharpe Ratio, the greater the risk-adjusted return. Farmland’s Sharpe Ratio across the past quarter-century is a whopping 1.4. In contrast, Gold has a mere 0.24

Sharpe Ratio in this period of time while the S&P 500 stands at 0.44. In layman’s terms, this means farmland’s risk-adjusted investment ratio is superior to that of other major asset classes.

FarmCek Makes Farmland Investing Easy

It is clear this is the optimal time to invest in farmland and FarmCek makes the investment process simple. We focus on high profit potential, domestic specialty crop operations. Exploring these opportunities is simple. Sign up for a FarmCek account, determine the farmland investment best for you, easily invest in just 3 steps, then monitor your farmland investment in your farmland investing dashboard. Click here to create a complimentary FarmCek account and begin exploring available farmland investment opportunities.